Russia invaded Ukraine in late February, and the war has continued since then.

Ukrainians have been resisting back as NATO countries also have supplied them with arms to support their ability to do so. Russia is strong aerospace and nuclear power, but its ground/logistics game is not its strong point. Russia currently controls large parts of eastern Ukraine, but their earlier push toward Kyiv (Ukraine's capital) was unsuccessful.

Alongside their aerospace and nuclear capabilities, what Russia has in terms of leverage at the geopolitical poker table is commodities, and the political organization ot wield that leverage rather effectively.

It's not some tiny rogue state; in addition to being a major nuclear power, it's the biggest natural gas exporter in the world, the biggest fertilizer exporter in the world, the biggest wheat exporter in the world, the biggest palladium exporter in the world, the second-biggest oil exporter in the world, and a major exporter of nickel, coal, copper, and other commodities. In short, it's probably the most important individual country for commodity exports, which makes sense considering that it has the biggest landmass.

Some American analysts say, "Russia is only 1.5% of global GDP, which is similar in scale to Italy," but that misses an important point. Commodities are a small percentage of global GDP but are the foundational input for everything else.

Without essential commodities, a large percentage of the rest of that GDP comes to a grinding halt. Add significant aerospace capabilities and nukes to that mix of commodities, and Russia is worth a lot more than 1.5% of global GDP. I also generally view total energy consumption as a better indicator of a country's true economic size than nominal GDP, and by that metric, Russia is five times as economically big as Italy.

As a result, Russia punches far above its weight geopolitically and in terms of macroeconomics relative to Italy, despite similar GDP figures compared to Italy. But of course, between the two I'd rather live in Italy.

Due to high energy prices and reliance on Russia for delivering them, many of Europe's national economies are floundering now. Their continental energy security is very much in question for a significant period of time going forward.

Germany is falling back even more on coal as an emergency option if their natural gas is shut off. Ironically, Germany kept its reliance on coal due to its push toward denuclearization. In XM live market analysis sessions, I highlighted how Germany could have phased out more coal if they had stuck with nuclear but did not.

One year ago, also on XM Live trading sessions, I ranked Russia a 5/5 in terms of fundamental currency strength. It had a fiscal budget surplus, low debt, high foreign reserves to GDP, including a significant gold component, and a structural current account surplus. It had weaknesses, of course, such as slow growth and very high corruption, but its currency metrics were among the best. I was not anticipating a war, however.

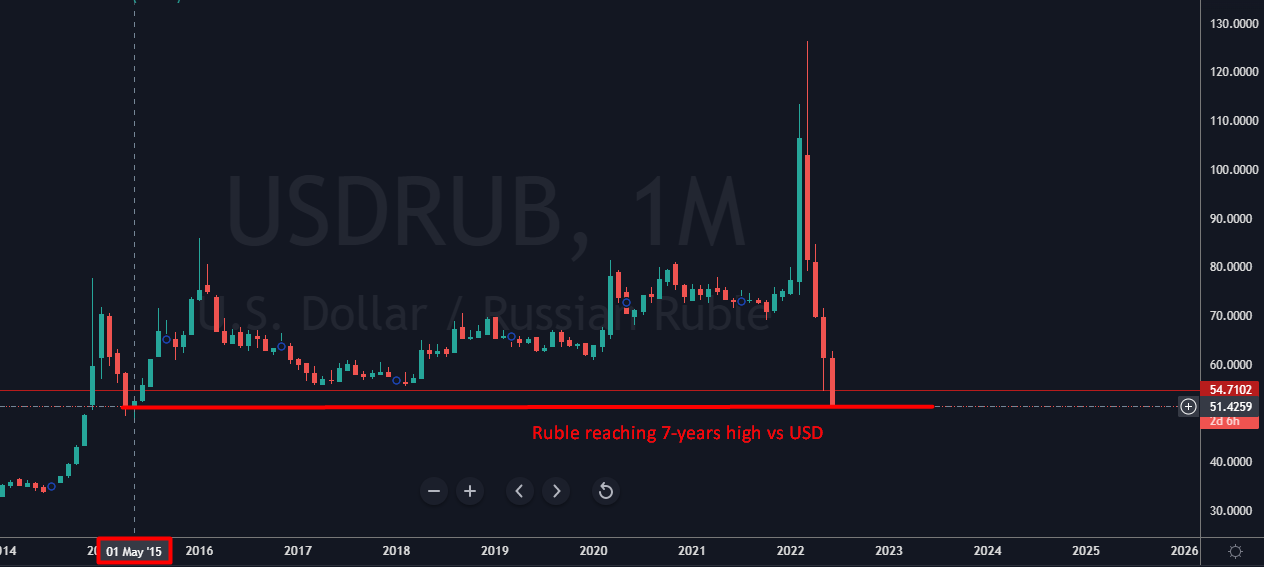

After a brief collapse at the beginning of the war, the value of the Russian ruble relative to the dollar and euro recovered sharply to hit a 7-year high. It's the best-performing currency of 2022.

Some analysts say this increase in ruble strength is merely a result of Russia's capital controls, and therefore that it's an artificial figure. While there is some truth to that, the fact is that capital controls don't work if a country does not have critical exports that the rest of the world needs.

It's the specific combination of capital not leaving, but capital still going in, that is driving up the Russian currency.

Several western nations sanctioned Russia, which reduced Russia's import capabilities. This has a real negative effect on Russia's economy; they have a lot more economic frictions and shortcomings due to this. These import restrictions, combined with Russia's capital controls, reduced the ability for capital to leave Russia. At the same time, however, the West and the rest of the world still buys Russian commodities, and many of those commodities went up in price. And so, the rest of the world is still pouring capital into Russia, out of necessity. In fact, Russia was able to ease its capital controls last month, and yet its currency still headed higher.

Basically, as a result of multiple countries limiting Russia's imports and still buying Russia's high-priced exports, Russia's trade surplus and current account surplus exploded higher, along with their currency value.

Meanwhile, China and India are able to buy Russian oil and other commodities at a discount to what western nations are paying for the same things.

- "TOKYO — China and India have increased Russian oil purchases as prices decline due to Western import bans, the latest data shows, creating a loophole that allows Moscow to secure export revenue.

- China imported 800,000 barrels of Russian petroleum daily by sea last month, according to data from Refinitiv, a figure that does not include oil delivered via pipelines. The volume has soared by more than 40% from January.

- The number indicates that China is deliberately going after cheap Russian crude. India's marine imports of Russia's oil also spiked from zero in January to nearly 700,000 barrels a day in May.

- –Nikkei Asia, June 8th 2022

Russia can also blend its oil with various OPEC nations. They can sell oil to them, who then resell this fungible oil to the rest of the market. Many developed countries will optically reduce their reliance on Russian commodities by not buying directly from Russia, while still actually using them, as they get mixed in with the rest. Meanwhile, many developing countries will continue to buy directly from Russia, and get a discount for doing so.

Along these lines, I think over the next 5-10 years, global FX reserves will diversify a bit more, and that the "gold" and "others" categories in the chart below will increase their share to some extent. That doesn't mean, however, that any asset in that chart will eclipse the USD in reserve share any time soon.

The USD+EUR share peaked in the early 2000s with over 80% share of global FX reserves, with only 8% of the global population. That was likely the high water mark. The world seems to be going from being unipolar to being more multipolar, which is likely to extend to more diversified FX reserve practices over time.

Adversarial countries have less incentive to hold each others' liabilities as reserves, gold as a neutral and inflation-protected asset is more desirable, and to the extent that countries do want to hold other countries' liabilities as reserves, an emphasis on recycling trade surpluses into their biggest trade partners' financial assets is the path of least resistance.